Fascinating book. To the point and practical.

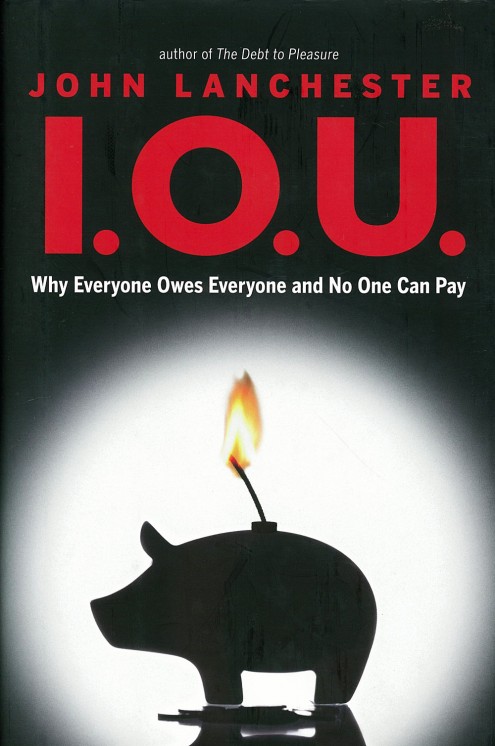

For example, the best way to describe a retail bank is to call it a piggy bank. The best way to describe an investment bank is to call is a casino, which is precisely what each are.

Who knew a book about high finance, banking, and The Great Recession could be such a fun read?

Any Smooth Harold readers out there that have tried them? There rates, zero fees, and easy access sound great.

In case you didn’t know, I don’t like Wall Street. It’s not that I think the stock exchange is wrong, but I don’t like how its description went from being “speculation” to “investment” in the last 50 years. And I don’t like how it’s primarily sold to the uninformed public.

If you watch TV, chances are you’ve seen numerous investment commercials for Prudential, ING, Pacific Life, Merill Lynch, Charles Swab and countless others. What you might not have seen is the fine print during all this commercials: “Investment products may lose value” and “Investments involve risk.”

This of course is neatly tucked away at the bottom of the screen while some voice over promises an increase in wealth, a secure future, and guaranteed retirement. It’s yet another reminder that what these people are really selling is speculation.

In other words, know your stuff before playing the game, or stick to what you know if you want to protect and grow your principle.