My adorable daughter photographed by my devoted wife Lindsey

I love this fact-based, feel-good article by Ben Carlson: “Since 2008, we’ve experienced flash crashes, government shutdowns, natural disasters, trade wars, a contested presidential election, a pandemic, and the fastest bear market in history. Yet the Dow rose from 11,497 to more than 36,000 and counting. Maybe our best days are behind us. Maybe it will be impossible to see the same amount of growth going forward. It’s certainly possible. I choose to believe that most people will continue to wake up in the morning looking to improve their lot in life. People have been betting against the U.S. economy for decades. They’ve never been rewarded for it. Progress is in our DNA. Good luck betting against it.”

More rare color photos of the depression here

More rare color photos of the depression here

As seen on Yahoo News: “The most obvious way out of this mess is for bankers and developers to build or convert existing units into affordable studio apartments for the masses… Those kind of units created an on ramp to home ownership in the late 50s and early 60s. Instead, residential insiders are waiting for the country to be forced into some big public jobs initiative in hopes that property values can be propped up to levels that won’t massively threaten equity. They’re waiting for somebody to save them from the market instead of responding to it. Somebody’s got to take initiative. Will it be industry or government?”

I’m a little late on this (gulp, nine months late), but I found it interesting. From the U.S. Census Bureau, via Suite 101:

- Civilian aircraft including parts … US$74.7 billion, up 1% from 2008 (7.1% of total US exports)

- Medicinal, dental and pharmaceutical preparations … $46.1 billion, up 14.1% (4.4%)

- Semiconductors … $37.5 billion, down 26% (3.5%)

- Other industrial machines … $30.9 billion, down 19.1% (2.9%)

- Automotive parts and accessories … $30 billion, down 24.6% (2.8%)

- Telecommunications equipment … $28.7 billion, down 12.6% (2.7%)

- Passenger cars … $27.5 billion, down 44.5% (2.6%)

- Medicinal equipment … $26.9 billion, down 0.5% (2.5%)

- Electric apparatus … $26.1 billion, down 15.5% (2.5%)

- Plastic materials … $25.5 billion, down 19.3% (2.4%)

The biggest drop last year was in passenger cars, which went from being our third largest export in 2008 to our seventh. Ford is still awesome though.

See also: My new favorite commercial

Get an overpriced degree from a diploma factory. (Plus two free movie tickets! Now that’s higher education.)

Now before any dreamy eyed Obama voters get offended by the timing of this, I’m in no way calling our nascent President a failure. I’m still hopeful. But as an American, I want answers, which is what good reporting should be seeking anyway. So why haven’t these questions been asked (or maybe I missed them)? Continue reading…

I interviewed Chris Anderson (Wired editor, Long Tail author) for a story I’m working on about the future of beta as it pertains to the web. While talking, I digressed to the subject of business models, to which he said, “I think launching without a business model is fine, if your costs are low enough.”

A year ago, I would have no problem agreeing with Anderson, especially given the low overhead qualifier. Google launched without a business model — why not? But in an depressed economy where credit is tight, consumers aren’t spending, and job security is threatened, I’m not so sure.

Convince me, dear reader: Is it ever okay to launch a company without a business model?

Lindsey and I gave few gifts for Christmas this year — virtually none to friends and family (gulp). I justified the stinginess given the imminent economic apocalypse.

Now, as the wee hours of Christmas are upon me, I feel like a grinch. Only I have no sleigh full of toys to return to double the size of my heart. Happy Holidays?

At least my three year-old is getting something.

Boston.com has published an interesting story surmising what a depression in the 21st century might be like. While the Great Depression and all its similarities to our current situation was very public, the New Depression (defined as a recession lasting a few years and unemployment upwards of 25%) will be very private, the article suggests, given the proliferation of the Internet to perform many daily duties including shopping, banking, entertainment, and communication. In short, author Drake Bennett expects long lines at the ER since people will drop their health insurance, a television boom since it’s the cheapest form of entertainment (movies and baseball were in the 30s, but not anymore), and barren suburbs due to crashing home values. Oh, and those shiny gadgets (bu-bye iPhones) will be traded in for reliable and durable tech like Nextel phones, and people will stop consuming organic food and other snobbery items because they’re too expensive.

[Thanks, Connor]

The following metaphor is reputedly written by David Kamerschen, a professor of economics at the University of Georgia. In it, Kamerschen makes a convincing case for equal taxation, one that I generally agree with.

But those substantial tax credits (read: the distribution of wealth) that I receive every year just for having kids are really, really nice. So consider me undecided on the matter (wink, wink).

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this: Continue reading…

[Via email. Thanks, Tim.]

Answer: They all support $700 billion bailouts for reckless Wall Street investment banks. And they don’t care if taxpayers absorb the mistake, because taxpayers pay said officials’ mortgages.

I’m no conspiracy theorist, but if that’s not proof that Wall Street has its hand in the pockets of big politicians, more so than normal, I don’t know what is.

And you’re kidding yourself if you think this country still runs a two-party system. There is no such thing as “Decision 2008.” McBama (aka big government) is going to win.

Nevertheless, make your voice be heard and write-in Ron Paul for president. If he siphons even just one or two states from The Nationalist Party next month, the publicity will further propel his message of the Constitution, free markets, greater state power, and responsible spending necessary to save the dollar.

The United States is nearing bankruptcy, and yet officials want to borrow more money (!) to curb economic woes, according to today’s headlines. It’s amazing how fiscally incompetent these knuckleheads have become — they’ve all but defecated on our once precious dollar.

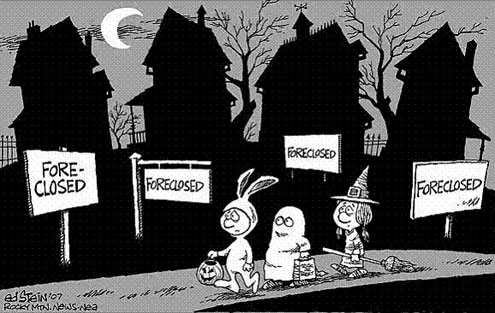

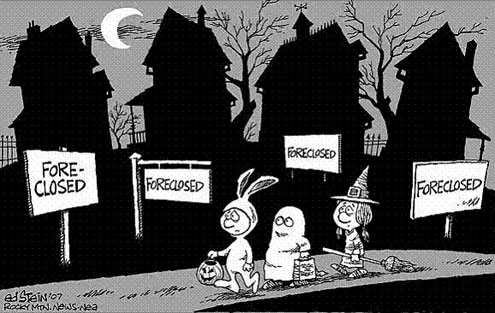

As harsh as it sounds, natural consequences (i.e. bankruptcy, foreclosures, loss of jobs) is the only way to atone for our country’s overly optimistic and unchecked enthusiasm of recent years. This includes irresponsible land developers, loan officers, politicians, investment bankers, and home owners who bit off more than they could chew — all of whom ignored the basic principles of supply and demand.

Dude, where’s my country? I feel like I’m taking crazy pills.

See also:

In case you’ve forgotten, the US economy is ginormous. Strange Maps tells why:

Although the economies of countries like China and India are growing at an incredible rate, the US remains the nation with the highest GDP in the world – and by far: US GDP is projected to be $13.22 trillion (or $13,220 billion) in 2007, according to this source. That’s almost as much as the economies of the next four (Japan, Germany, China, UK) combined.

For even more context, click on the above US state map renamed for countries with similar economy sizes. Amazing…

Hat tip, USA.